First of all, a definition: a stock (popularly called shares) as far as the stock market is concerned is a means of identifying ownership in a company. So a stock-holder (or shareholder) is an individual or institution that has a claim on part of a company’s assets – so if you have 1 share (or stock) in Chevron PLC for instance you are part of the company’s owners! How amazing – right?

On, the 22nd of September, 2016 the top gaining bank was Zenith Bank PLC (ZB) and one of the top losers was Unity Bank PLC (UB). How does that affect an investor or even me?

An interesting thing to bear in mind is that the stock market (more or less) affects prices in terms of demand and supply. So when people want to buy a stock and no one is selling, the price jumps and the reverse is the case when people want to sell – prices fall. This is also the case when a stock has plenty of “activity” on it. E.g. ZB had 389 trades on it while UB had a miserly 6. Does this mean that ZB is a better investment to UB – not really! Let me explain why…

Nobody will just throw away money for the fun of it (well those people that I know that is) and I for one will only put my money (invest) where it will bring me more money (fortune) and if I am not happy, I will simply move my money away from there to somewhere else I think is better. To do this, I will (as I am a strong believer in value growth investment) look at the following metrics: EPS, P/E, P/B, FCF, PEG, CAGR and ROE just to mention a few but I will be looking at how 2 metrics will explain my point.

EPS

This is defined as the earnings per share or in more elaborately, for each share of the company I own, how much money has this company earned/ generated. This is used to measure the profitability of the company. This number needs to be evaluated on a year-on-year basis so if it is increasing great if not huh….. Look deeper!

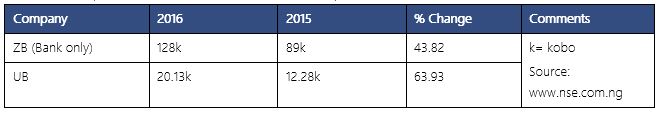

Let us now compare ZB with UB based on their 3-month reports.

What this tells me is that the shares of UB have gone “up” much more than those of ZB. So UB wins this round!

P/E Ratio

This is arguably one of the most common metrics that is used in valuing stocks. It is calculated by dividing the stock price by the earnings per share. Let us say we want to buy a new pair of shoes; we would want to look “price” the shoes that are available – especially the perfect ones. If we see that all of them have similar qualities but one is particularly cheaper than the rest we may decide to buy that one, won’t you? It is the same with stocks – if there are 2 stocks and one has a higher P/E ratio it is overvalued relative to the other one of similar characteristics. Another illustration I read about is if you have two investments and one will pay you your money back in 3 years while the other will in 500 years, which one will you invest in?

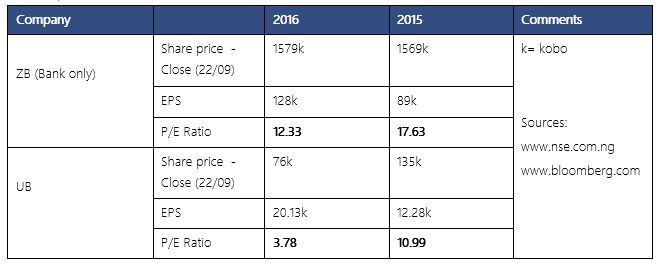

That said, let us look at our two stocks:

We can see that both stock’s P/E ratio came down year-on-year but the issue is that ZB is “overvalued” relative to UB – again UB wins.

We are not drawing any conclusions from the simple analysis done above but we can see that as far as the “fundamentals” are concerned, UB is considered to have more potential for investor value creation relative to ZB.

So next time you see news headlines like “Top Gainer’s” or “Top Loser’s” don’t be alarmed (well not too much) unless there is something fundamentally wrong like bankruptcy or management embezzlements.

Till next time…