In part 1, I discussed income statements (IS) and statement of cash flows and touched on the similarities and differences between them. For this discussion, we will be using the income statement as a foundation and the basis of our conversation with the principles of the cash flow statements for guidance.

We will be discussing:

- What a budget is

- Why it is important

- How to create a budget

- Budgeting and Tracking

- Categorising Costs and

- Benefits of a Budget

What is a Budget?

In my view, a budget is essentially a way to estimate or potential expenditure and income within a specific time frame. It can also be referred to a financial plan, forecast or expectation. It allows us to write down our expected incomings (salaries etc.) and our expected spend.

Why is it important?

Budgets allow s us to see the quantity of money that we are letting go of and can help us prioritise:

- How we spend our money

- What we spend it on

- Identify why we spend it

Budgeting can help us correct any “bad behaviours” in our spending, improve our credit worthiness, achieve our personal targets and objectives, measure our performance and plan – good or bad.

How to create a Budget

As individuals, we spend our hard-earned cash (well that is how I get mine) on a variety of stuff but spending without a plan can get us bankrupt. That said, here is how I do my own budget – a very easy step by step process.

- Establish what I want to achieve otherwise known as a goal or desire

For example, do I want to go on a holiday in 3 or 6 months? But remember that whatever it is that you have identified, ensure that it is very specific.

- Identify where my money is coming from

- Identify what I spend my money on

We should categorise our expenses. We will look at this later in this part.

- Adjust my budget if needed

Budgeting and Tracking

I like looking at what companies do as it is a very good way of seeing how and what I can do to make myself financially free.

Income Statements

Companies use the income statements (IS) to show their shareholders and the wider public how they have performed however they are a great template for preparing a budget. In this part, we will look at the different aspects of a standard IS, how we can use it for budgeting or planning personal finance and a sample layout of what it could look like.

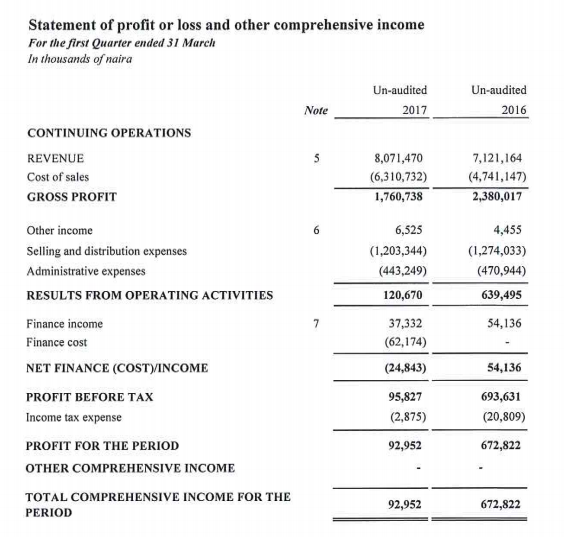

The image above is a sample income statement and as I mentioned, it serves as a guide on how you could arrange your own budget template. Below is a breakdown of these items and their interpretations and what we would potentially add to these layers in formulating our template. Now it is important to note that there are various ways companies can present this information depending on the rules of the country they report in, their industry, the methodology they use (single or multi-stage more on this later) etc.

How do I Relate the Income Statement to My Budgeting Process?

The first thing that we need to make clear is that all our expenses as individuals (from a personal finance perspective) are based on cash (well most times) while that made by most businesses are “credit-based”. So while companies buy and sell on credit, we the “masses” spend money as we earn.

That said, I will be going through each of the line items in this income statement and explain how we can use it for our “personal finance” (PF) statement.

Continuing Operations

This tells us about income from core activities of the company. So any revenues from mergers/ acquisitions, divestments or discontinued operations are not included here.

PF definition:

For those of us who earn our income from employment, we will call this income from Continuous employment.

Revenue

Represents revenue from sale of key products that a company has made within the period.

PF definition:

Salaries or income from regular employment as well as benefits from employment after tax.

Cost of Sales

These are the costs directly related to the products that the company creates/ sells. It includes materials cost, direct labour costs, transportation costs etc. related to making that product or providing the service.

PF definition:

These are costs of generating the salary we are talking about. Includes transportation, housing/ accommodation, food and personal care. We will refer to this as Primary Costs.

Other Income

This one is quite interesting but we can (for simplicity) call it the revenues from other aspects of its operations. For example, a refinery’s final product could be Premium Motor Spirit (Petrol or PMS) which is produced from crude distillation but as a bye-product of this process “Coke” is produced. If the company sells the Coke, this revenue can be classified as other income.

PF definition:

Any income that you receive from other employment (please note this should be after tax) is put in here. You can also include interest, dividends and/ or coupons received as we can argue these incomes arose from investments that were made during employment or you may decide to locate these in another spot in your model. This we will still leave as Other Income.

Selling & Distribution Expenses (SDE)

The items here include all the costs associated with sales process of the goods produced. They include salaries, commissions, traveling and entertainment expenses of all the salesmen. These may include marketing managers, sales director and management and of course the “foot soldiers”. It also includes costs of maintaining delivery vehicles, discounts to customers and of course debts that cannot be recovered. The fact is that some companies do not need special salesmen as customers can come in and buy the goods they want or we can outsource this task so we may not need them in-house. Especially for small companies!

PF definition:

This includes any other costs that we can do without like legal fees (many people may never pay the lawyers :)), entertainment, expenses to relatives, gifts as well as donations. For this reason, we can call them Tertiary Costs.

Administrative expenses (AE)

These are the costs associated with providing administration and management for the business and they include salaries of the office staff, management and directors; telephone, postal costs, stationery, lighting, heating, rent, insurance etc. Essentially, other costs that the company needs to incur to ensure smooth running of the business aside the primary costs.

PF definition:

These costs are in my opinion Secondary Costs and will include expenditures related to the following: school fees, insurance, loans, pets etc.

Finance Income & Finance Costs

Finance Income are the funds the business receives from interest, coupons etc. while the costs are the opposite – payments.

PF definition:

These are already classified as Other Income (for Finance Income) and Secondary Costs (for Finance Costs).

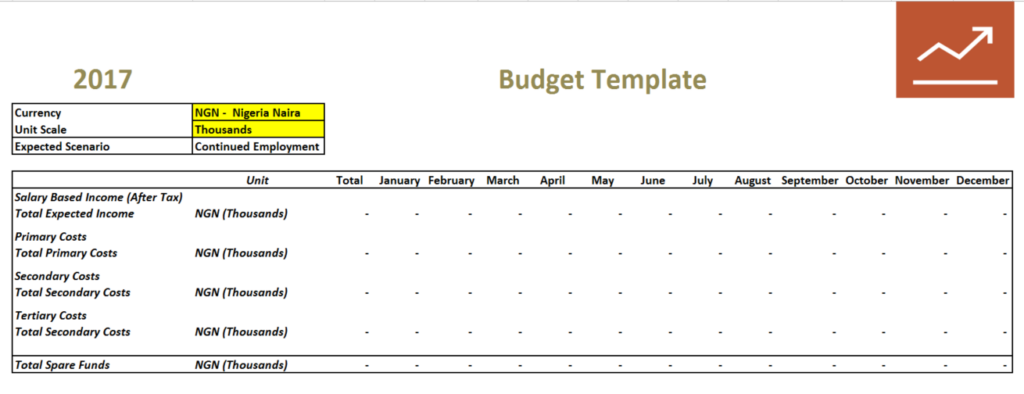

Personal Budget Layout Now that we have defined the various categories from a personal finance perspective, find below an image depicting the line items that we have mentioned.

In the excel file, these will be broken down into various elements that we can use. Please note that these can be adjusted for your personal circumstances.

Categorising Costs

The key issue here is to ensure that we maximise the Spare Funds in our model. To do this, we need to populate our costs from important to least important in the following order of priority:

- Primary costs

- Secondary costs and finally

- Tertiary costs

Remember, tertiary costs can be eliminated (or avoided), some secondary costs can be eliminated, or reduced while the primary costs go nowhere – they will be incurred!

Please note that this priority as well as the elements are based on my own circumstances and yours may differ.

The reason for this is that, the real amount of money we can invest in properties, stocks and bonds etc. come from our Spare Funds so watching how we spend and what we spend it on is very important.

Benefits of a Budget (or Plan)

There is as adage credited to Sir Winston Churchill that goes like this, “He who fails to plan is planning to fail”.

Businesses make what is called a “business plan” that allows them assess the project(s) that they will invest in within the next 1, 2, 5 or 10-year time frame. They do this for various reasons that may include planning for growth/ expansions, tracking progress or planning their cash flow. A key item that is generated from the business plan is the financial plan. All the big companies that exist did not just rise from nowhere, there was a plan, specifically a financial plan.

A personal finance plan in my opinion incorporates the current funds from continuous employment and other sources as well as other items like expenses known to us at a specific point in time to predict future flow of resources – cash in and cash out. With this in mind, the following are a list of benefits of having a financial plan:

- You can monitor how you spend your money and what you spend it on

- Since you have a budget, you automatically have goals – try not to exceed your budget!

- It can be used to track your plan vs your actual spend and it

- Helps with personal discipline and accountability

In this part, we looked at different regions of a standard Income Statement, how we can use it for income budgeting (or planning), the benefits of a budget and a sample layout of what it could look like. As can be observed, we have used a key principle of cash flow statements of only accounting for “cash spent” or money that left our pocket. In the next part, we will discuss the balance sheet and how we can learn from businesses to build our very own personal balance sheet.

Till next time, I remain…

Your Investment Analyst.