I have heard so many quotes about the past and future but 2 are quite interesting to me. I say “interesting” because they go against my understanding of financial management and somehow, they are paraphrased as meaning “it’s not worth it” to review one’s past – this is what someone said to me when quoting these sayings!

Well, there is this saying translated from my native tongue – Igbo:

“A person who doesn’t know where the rain started to beat him or her should not expect to know when it will stop beating him or her”

What this means is you must pay attention to your past as it influences your present that then influences your future.

This said, I referred to my financial management understanding earlier because of what we do broadly. We consider the past performance of a company or individual (even though this does not give an indication of the future) to make decisions in the “today” (present) that will affect the future of our client’s investment(s), or personal finance. This process is called fundamental analysis more popularly referred to as financial analysis.

Brief

Fundamental analysis is the bedrock for effective financial planning. For companies, it is the process of reviewing what they have done in the past to try and predict what they have the potential to do. We can obtain this information from their financial statements which they obliged to provide to the government and their stakeholders.

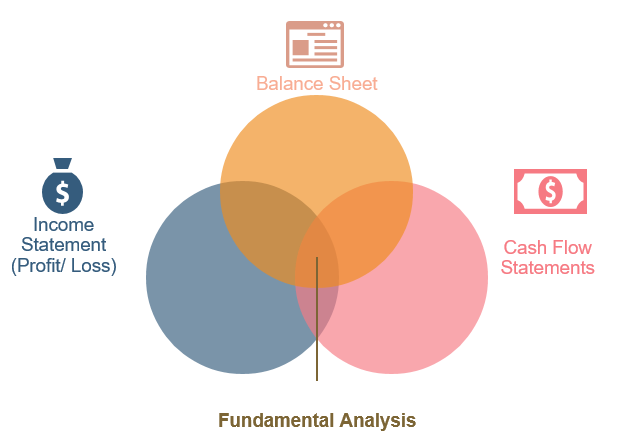

Every company has stakeholders (people who need to know how they are performing) and these stakeholders may have different or similar reasons why they are interested in the performance of the company. These stakeholders include but are not limited to business managers, potential investors, current shareholders, creditors, debtors, employees, financial institutions, competitors, government tax offices (as mentioned) and the public. The key issues that will need to be looked into are the company’s profitability, solvency, liquidity and general performance. Their interaction in indicated in the Venn diagram below.

In this series, we will be looking at how companies review or show their books (or financial statements) to their investors. The purpose of this exercise is to bring us to a position where we know what it is that we have currently and how we can build on this to increase both our financial acumen as well as our financial wealth. In this case, we will be our own investors however if you are married with or without children or have other dependents, these will consist our investors or shareholders as they will benefit with our achievements. So, for individuals, it should not be so different!

What are Financial Statements?

There are 5 types of financial statements that companies present to their stakeholders which are the balance sheet, statement of cash flows (cash flow statement), income statement (profit & loss), statement of comprehensive income and statement of changes in equity. For this series, we will be discussing only the first 3 of these statements as they are much more pertinent to us and their interaction is shown below.

Balance Sheet (BS)

This is also known as “statement of financial position” because it provides the stakeholders with information of the company at a time (usually 31st December). The data provides allows investor’s make informed decisions on the risks associated with the company. Not only does it allow estimates of risk to be assessed, it provides information about their assets (what they own that generates money for them. They are classified as current and long-term assets), liabilities that the company has (obligation that the company owes to people, companies, banks etc. that are classified as current and long-term liabilities) as well as the equity (what the business owes the owners e.g. shareholders. This is presented as retained earnings, reserves as well as share capital).

This “book” or statement is quite critical for this conversation because from a personal finance perspective, you want to know where you are at a point in time in terms of what your assets are (e.g. a house), what your liabilities are (loans and long-term credits) where you are with your immediate debts that can be called in within the year or even 3 or 6 month periods. You are not a company so you have to be both honest with yourself and realistic in terms of your financial position.

Income Statement (IS)

This is also known as “Profit & Loss account” and it tells us about the profitability of the business. Unlike the Balance Sheet that looks at the accounting position at a specific date, the income statement gives “an idea” of how a company generated and used its revenues during a period which can be 3-, 6-, 12- or 36-months to create shareholder value as seen in the net income.

It is based on accruals perspective which is simply explained as saying, a company can record sales (revenues) in January even if the money will be received in April (e.g. credit sales) if the deal was made in January while expenses that would be paid in April must be recorded in January if that was when “the deal” as made.

This statement is an important one for analysts that follow a company (or stock) from a fundamental perspective because it informs investors about the company’s earnings – which in turn is used to value the company’s stock amongst other activities. From a personal finance perspective, we can use it as well as its many of its principles to properly design a financial budget or plan.

Statement of Cash Flows (SCF)

This is also known as “cash flow statement” and it tells us how the company has spent its funds – in particular, cash. It is different from the income statement (as it doesn’t consider items like “credit sales” as cash, unlike what happens in the profit and loss account) and is divided into 3 parts. This is important to note because it draws its information from the income statement, balance sheet and a lot of notes from the financial statements. In my opinion, this is the most important statement as it relates to personal finance and we will discuss this in another part. The 3 parts of the cash flow are cash flow from operations (CFO), cash flow from investing (CFI) and cash flow from financing (CFF).

- The CFO tells us how the company has spent its cash from an operational perspective there are a few metrics that are involved with this (however that is not a conversation for today)

- CFI on the other hand, tells us what investments (bought or sold) the company has made during the period that are long-term in nature and

- CFF conveys to us information about the loans, repayments, bonds etc. that the company has made during the period.

Summing all 3 parts of the SCF, gives us the net cash position of the firm/ company. It is a fascinating statement as it can be “assembled” in 2 ways called the Direct and Indirect methods and it combines aspects of the balance sheet and income statement as well as notes from the financial statements (for clarity).

This statement is also of equal importance as the balance sheet as we (especially full-time employees) get paid periodically and it is from these payments all our expenses are made almost immediately!

Now, this is the reality of our situation, when we get paid at the end of the month, we have expenses which we make, and all of this is based on cash flow. Ergo, the need to understand this statement of accounts!

Conclusion

The series will be divided into 3 parts. Part 1 which we have here is an introduction. Part 2 will deal with a combination of the principles of both the statement of cash flows and Income Statements with special emphasis on the latter and how it will benefit our financial future through budgeting & planning. Finally in Part 3, we will be looking at the importance of the balance sheet and how we can use it to determine what our personal financial position is.

Till next time…

Your Investment Analyst.